The Association of South-East Asian Nations adopted a master plan in 2016, which aimed at increasing connectivity by 2025. The Master Plan (MPAC 2025) focuses on physical, institutional and people-to-people connectivity. This connectivity needs to be achieved by focusing on developing key areas such as sustainable infrastructure, digital innovation, people’s mobility, logistics and regulatory practices. For a region like Indonesia or Malaysia, if they invest in people-to-people connectivity, they can focus on the tourism sector, which will contribute to their GDP growth and skilled labour mobility as well.

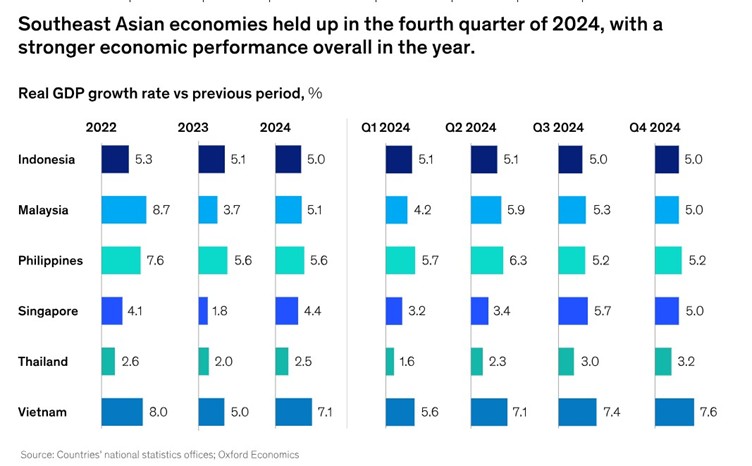

The performance of the Southeast Asian countries in the previous three years shows that countries such as Indonesia, Vietnam, Singapore and Malaysia were able to maintain a good GDP indicator for growth in their economies. Over the last few decades, the regions of Southeast Asia have seen an increasing inflow of FDIs, which has fueled trade openness, growth and labour force expansion and growth of the market (Emako et al., 2022). The region’s FDI stock expanded by 56% over the past decade, rising from USD 2.5 trillion in 2014 to USD 3.9 trillion in 2023, increasing its share of global FDI stock from 6.9% to 7.9% (Chizema 2025).

These countries are working on connectivity, through rail, water and air, where the link from all major cities can be connected. Singapore and Malaysia have become one of the major tourist destinations in the east, which also improves the inflow of capital to these economies. The Johor-Singapore Special Economic Zone is an initiative with a similar motive which aims at combining Singapore’s strength in research and development with Malaysia’s industrial capacity (Guild 2025). Cities are known as the engines of growth, and they generate revenues for the economy. On the other hand, there are situations where the development that takes place in the cities may not lead to rural development, for example, the Bali islands are famous for tourism, but the islands do not have enough infrastructure in terms of roads to these villages. The development is only at the centre and not in the peripheries (Suthanaya & Suwarningsih, 2022). 2022). In that case, the smart village concept was adopted as per UN recommendation, where it is vital to improve the quality of life in rural areas by integrating development and a technology platform model; this was adopted by Indonesia. The implementation of this project was successful considering the fact that the country was able to reduce unemployment (from 3.72 to 1.21 per cent), increase the number of self-reliant villages (2894 to 5559), and decrease the number of underprivileged villages by 30 per cent.

In the past few years, the region faced strong growth in terms of its exports, where it exported mostly electronics. Imports were mostly of immediate and capital goods, mainly for supporting industrial production and investment activities. The tourism sector has been made strong by investing in eco-tourism, heritage sites and by making tourism affordable. Similarly, the ASEAN Village network in Indonesia works towards multiple goals of making a tourist village/digital village and the development of disadvantaged regions and transmigration, where they have adopted some villages for a pilot study. Even though these plans exist, there are still a lot of barriers, especially in the decision-making and implementation processes. The emergence of smart villages to support the resilience and development of underdeveloped regions is an innovative approach towards development (Entang et al., 2023).

Higher risk and lower return on investment were pulling the private investors back. FDI inflows have been increasing in all of the Southeast Asian countries, which is a sign of future growth. The exports increased with respect to private consumption in Indonesia. The geographical landscape of these countries is also very unsafe for the government to make huge investments. Places such as Thailand and Indonesia are also prone to natural disasters such as earthquakes, floods, etc., which makes it an even riskier place for investment.

ASEAN, on those grounds, have aided these regions to perform better in the global world. Economic integration has helped the countries to view ASEAN as a single country and then make investments so that they set their factories in the area and get cheap labour. Companies can save their production cost and also focus on specialisation, thereby aiming for economies of scale and long-term profits.

Successful negotiations of numerous FTAs (Free Trade Agreements) with major economies such as India, China, Australia, Japan, Korea, etc., help the region in lowering the trade barriers and securing market access for further businesses. The Regional Comprehensive Economic Partnership (RCEP) has helped to align with almost half of the world’s economic leaders. This alliance will contribute to half of the world’s population and 30 per cent of global GDP.

This integration will enhance the trade relationship the country has with the rest of the world. When Singapore is a major transit point for many international trade routes, its alliance with the major economies will help in strengthening its trade relationship with the rest of the world as well. It is important at this point for ASEAN to decide whether they have to focus on long-term investments like education, health and reducing poverty and inequality, along with addressing climate change issues. The capital investments that the country is pitching in currently require a lot of investment, which cannot be raised through internal sources; they need to mobilise their resources from other sources.

The region needs to address the larger question of what ASEAN’s connectivity strategy risks overlooking if it focuses too much on physical infrastructure at the cost of social infrastructure. The region has to invest in social indicators such as higher education, skilled workforce, job creation, better health care systems, along with sustainable practices of carbon emissions, such as carbon pricing and decarbonisation of the economy. Singapore, Malaysia and Thailand are the major recipients of migrants, while Indonesia, Malaysia and Myanmar are major sources of supply with respect to skilled and low-skilled workers (Hill and Menon 2010). Support networks and a well-educated populace are capable of adapting to change and are crucial for a society’s resilience against economic downturns, natural disasters, and pandemics. An overreliance on physical structures alone can make a region fragile. The region should also strengthen the FTAs and PTAs in the region so that it can equip the community to grow as a common market.

Additional Reading:

Connect with the Authors