Based on the paper “FDI and regional development policy”, to be presented at the 2018 SMARTER Conference on Smart Specialisation and Territorial Development: Implementation Across Global Networks of Regions, Cities and Firms. Seville, Spain.

“Investment policymaking is getting more complex, more divergent and more uncertain.” (UNCTAD, 2017, xi). The aftermath of the economic and financial crisis of the late 2000s has seen growing populistic uprising against the negative consequence of globalisation, particularly intense in Europe and in the US. The widespread acknowledgement, in public perceptions as in academic and policy circles, that one of the most noticeable effects of the actions of Multinational Enterprises (MNEs) and their global investment operations is a steadily increasing within-country inequality has casted doubts on both the benefits of openness – a key-word dominating the European pre-crisis debate on regional development – and conventional policy tools to counteract its uneven impact across people and places.

Globalisation through foreign direct investment (FDI) has been changing swiftly in the last two decades, spurred by, and spurring in reverse, technological change. According to UNCTAD, FDI stocks as a percentage of world’s gross domestic product (GDP) went from around 10% in 1990 to around 35% in 2016; about two-thirds of world FDI stocks are now in service industries, although the advent of the Industry 4.0 paradigm has rendered sectoral boundaries more and more blurry; FDI has shifted from greenfield investments to Mergers & Acquisitions, from capital- to technology-intensive manufacturing, and further to knowledge-intensive services, from production activities to R&D, from sectoral to functional specialisation; the exponential growth in the number of MNEs in recent years has been nourished by small and medium-sized firms (SMEs); the geography of world FDI recipients and investors has also hugely widened, though most international investment and value creation networks span primarily across groups of neighbouring economic systems. Among these, the EU is the largest source and destination of FDI stocks in the world, overall retaining a position of net investor.[1]

The combined power of globalisation and technological change forces has demonstrated that geographical concentration and dispersion of production and innovation activities occur simultaneously: despite their partially eased spatial stickiness across national borders, agglomeration economies within countries have grown stronger, giving prominence to certain types of metropolitan regions and cities. The latter are the primary homes and hosts of major knowledge-based MNEs, and the true beneficiaries of globalisation, being centres of political influence, corporate decision-making and control, knowledge generation and exchange, new skills and jobs (e.g. McCann and Acs, 2010). Within the same countries of such places championing global connectivity, there are other cities, regions and industrial clusters facing both tougher international competition and lower (and historically decreasing) nation-state protection: many relatively routinized activities and occupations in both manufacturing and services industries there located have either become obsolete or moved to the Global South. These job destruction processes often reflect mid- to low- skills, income and management roles: the international outsourcing and offshoring of these tasks heavily contribute to greater levels of localised job polarisation (e.g. Driffield et al., 2009; Elia et al., 2009).

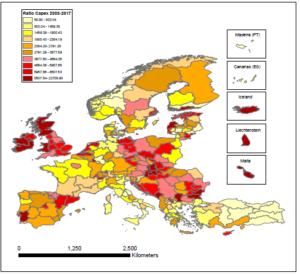

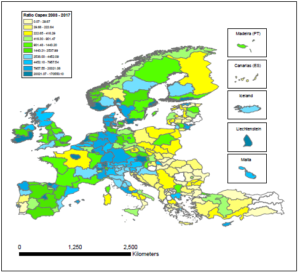

Such uneven positions in the ladder of roles and functions in the international division of labour broadly reflect the European regional development clubs recently identified by the literature (Iammarino et al., 2018). European top-performers regions – relative to national and EU averages in terms of GDP per capita and other socioeconomic indicators – display a rather balanced connectivity through inward and outward FDI flows, and an apparent capacity to manage integration between intra- and extra-region networks, proving to be relatively resilient to major economic shocks such as the 2008 crisis (Crescenzi and Iammarino, 2017). Maps 1 and 2 provide a simple illustration of connectivity across European regions based on world greenfield inward (IFDI) and outward FDI (OFDI) cumulative flows in the period 2003-2017 (including both intra- and extra-EU).

| Map 1 – Inward FDI into the European regions: cumulative capital expenditure (Capex) 2003-17 normalised by regional population |

Map 2 – Outward FDI from the European regions: cumulative capital expenditure (Capex) 2003-17 normalised by regional population

|

|

|

| Source: fDi Market database and Regions & Cities- Eurostat

See Crescenzi and Iammarino (2017) for further details. |

|

The spatial agglomeration of IFDI – represented by differently-coloured deciles – shows strong polarisation: FDI into Europe are either going to core cities and regions with very high levels of per capita income, or to peripheral areas at the very bottom of the regional GDP distribution. The top attractive locations are the UK and Irish regions, some of the capital city-regions in the Baltic and central and eastern European members, and a number of the most peripheral and poorest regions in Romania, Bulgaria and in the EU Candidate Countries. The geography of OFDI is instead mainly originating from the European core, i.e. the ‘Blue Banana’: global capital cities are top investors, though substantial investments abroad – particularly following the beginning of the economic and financial crisis in 2008 – have increasingly originated in the periphery.

The significance of worldwide FDI in the last decades has been accompanied by a salient surge and diversification of government policy instruments to attract foreign-owned companies in their territories by lowering entry barriers and providing a wide range of investment incentives. On the OFDI side, conversely, the attention has concentrated on privileging export promotion as the main, politically-sustainable, form of active internationalisation. In fact, the old evil alleged in relation to OFDI is employment destruction at home, consequent wage depression and unemployment surge (e.g. Janoski et al., 2014). However, offshoring is a growing phenomenon, spreading worldwide across economies with very different levels of development, and connecting their firms, increasingly SMEs, through global production networks and value chains. Governments’ support to active internationalization has been so far limited, and restricted to the large national champion companies able to exert power on both own and foreign political centres (e.g. Smith, 2015).[2]

The evaluation of connectivity through FDI among the goalposts of place-based policies in Europe, and related smart specialisation and regional advantage construction strategies (e.g. Uyarra, et al., 2014; McCann and Ortega-Argilés, 2015; Radosevic and Stancova, 2018), still remains today a “missing strategy” (Bailey and Driffield, 2007). A few guidelines can be extracted from recent interdisciplinary academic literature. First, policies for connectivity need be based on differentiation within both European cores and peripheries, and across and within regions in the same nation-state. Particularly in the case of OFDI, the general practice to design broad support strategies on the basis of effects that are, at the aggregate national level, neutral or positive, tends to condemn declining and peripheral regions to persistent marginalisation in the global division of labour. The reliance on global capital cities as gatekeepers of international capital flows as a growth recipe for the country as a whole seems not to be sustainable in the light of the rising populism and xenophobic attitudes in middle- and low- income regions (e.g. Rodriguez-Pose, 2018; Storper, 2018). As from the maps above, many of EU low-income peripheral regions are either very attractive (e.g. in the EU East), or completely disconnected (e.g. Southern Italy and Greece). On the other hand, numerous middle-income regions, for example in Germany, France and northern Italy, are not attractive at all but experience very strong FDI outflows: indeed, given the high heterogeneity of the group, middle-income regions are facing some of the hardest developmental challenges in the EU (Iammarino et al., 2018). These diverse types of regional combinations of economic wealth and FDI connectivity are to be found both across and within national boundaries.

Second, place-sensitive policies for connectivity require strong integration between the ‘silos’ of inward and outward FDI, overcoming once and for all the practice of welcoming IFDI no matter its fit with the regional economy, and disregarding investment abroad by domestic firms, especially SMEs willing to globalise. On the outward flows’ side most policy attention has been devoted to trade, manufacturing and the building of territorial comparative advantages, with limited consideration of how to promote social openness, stimulate – particularly small and medium – firms’ risk propensity for ‘going global’, and build institutional capacity to spur bidirectional exchanges. In addition, little or no attention has been paid to the sectoral and functional features of IFDI versus OFDI into/from the same region. Support to FDI attractiveness without careful consideration of what kind of activities is leaving the region – in which industries, and in which stages of the value chains (i.e. production, R&D, headquarters, sales, logistic/distributions) – is the wrong recipe for sustainable growth and renewal of local competitive advantages. Incompatibility of policy goals may arise when attracting foreign MNEs to reduce regional unemployment or upgrade skills, without simultaneously looking at the promotion of domestic firms’ growth through offshoring and international outsourcing. A more holistic industrial strategy is decisive to ensure a balanced and diversified structural change at the local level (Bailey and Lenihan, 2015) and to pursue openness without threatening the density of domestic relational networks in the region.

Third, place-sensitive policies for connectivity entail better coordination of ‘mission oriented’, top-down, science-led types of approaches, and ‘diffusion-oriented’, bottom-up, capacity-building programmes, achieving effective compromise and fruitful dialogue between the two governance views depending on the type of region. Since the crisis collective transnational awareness (and resentment) for outrageously low tax rates and individual firm taxation deals between governments and the largest MNEs has sensibly risen. The recent positions of the European Commission on Luxembourg violations of competition policy through illegal tax benefits is one of the best examples of supranational regulatory frameworks required to combat inequality.[3] Large MNEs based on intangible assets, exerting control on intellectual property rights, operating in increasingly elusive industry boundaries, and generating growing shares of profits[4], undeniably need concerted and binding regulation if equity issues have to be taken seriously. On the other hand, top-down approaches – national, European and international – account for the necessary conditions of a ‘fairer globalisation’, but do not tackle the idiosyncratic characteristics of places, i.e. the sufficient conditions for development (e.g. Pike et al., 2017). Rising cohorts of European SMEs need to be helped thinking globally to develop locally, and different city types outside the capitals may play a crucial role in connecting through interregional networks to the global economy (Uyarra et al., 2014) and in making their people feel less provincial.

To conclude, the evolution of the modalities of global productive capital flows has been rapid and drastic, as that of its geographical determinants and consequences, possibly reversing once-and-for-all the supremacy of the largest MNEs from the advanced North as world-leading investors. As highlighted by the past and present experience of the East Asian NICs, OFDI growth from emerging economies mainly reflected the reliance of domestic firms on government support in order to upgrade their ownership and location advantages; in these economies, the role of the developmental state and its relationships with domestic firms have significantly evolved over time (Yeung, 2016). The most salient recent case is China, whose OFDI has grown at an accelerating rate since 2000, as a result of a strong government commitment – progressively articulated at the subnational level – to encourage domestic enterprises to grow global (e.g. Wei, 2013). Despite Europe’s historic economic openness, its regions may need to look eastwards for inspiring lessons on regional economic development under globalisation.

Acknowledgements

The author grateful acknowledges financial support from the Regional Studies Association Fellowship Grants (FeRSA) 2017.

Bio

Simona Iammarino is Professor of Economic Geography at the Department of Geography & Environment of the London School of Economics and Political Science (UK). Simona’s main research interests lie in the following areas: Multinational corporations, location and innovation strategies, and local economic development; Geography of innovation and technological change; Regional systems of innovation; Regional and local economic development and policy. She has published more than 50 articles in major peer-reviewed journals, two co-authored books, around 30 book chapters, and numerous working papers, policy reports and other publications. She was co-editor of Regional Studies (2008-2013), and she is currently member of the Regional Studies Association (RSA) Publication Committee and of the RSA Research Committee. Simona is also a plenary speaker for RSA’s upcoming Smart Specialization conference, taking place September 26-28, 2018.

Are you currently involved with regional research, policy, and development, and want to elaborate your ideas in a different medium? The Regional Studies Association is now accepting articles for their online blog. For more information, contact the Blog Editor at RSABlog@regionalstudies.org.

References

Bailey, D. and Driffield, N., 2007. Industrial Policy, FDI and Employment: Still ‘Missing a Strategy’. Journal of Industry, Competition and Trade, 7:3-4, 189–211.

Bailey, D. and Lenihan, H., 2015. A Critical Reflection on Irish Industrial Policy: A Strategic Choice Approach. International Journal of the Economics of Business, 22:1, 47-71.

Crescenzi, R. and Iammarino, S. (2017) Global investments and regional development trajectories: the missing links. Regional Studies, 51(1): 97-115.

Driffield, N., Love, J. H. and Taylor, K., 2009. Productivity and labour demand effects of inward and outward foreign direct investment on UK industry. The Manchester School, 77(2), 171–203.

Elia, S., Mariotti, I. and Piscitello, L. 2009. The impact of outward FDI on the home country’s labour demand and skill composition. International Business Review, 18:4, 357-372.

Iammarino, S., Rodriguez-Pose, A. and Storper, M. 2018. Regional inequality in Europe: evidence, theory and policy implications, Journal of Economic Geography, https://academic.oup.com/joeg/advance-article-abstract/doi/10.1093/jeg/lby021/4989323.

Janoski, T., Luke, D. and Oliver, C., 2014. The Causes of Structural Unemployment: Four Factors that Keep People from the Jobs They Deserve. Polity Press, Cambridge MA, USA.

McCann, P. and Acs, Z.J., 2010. Globalization: Countries, Cities and Multinationals, Regional Studies, 45:1, 17-32.

McCann, P. and Ortega-Argilés, R. 2015. Smart Specialization, Regional Growth and Applications to European Union Cohesion Policy, Regional Studies, 49:8, 1291-1302.

Pike, A., Rodríguez-Pose, A. and Tomaney, T., 2017. Shifting horizons in local and regional development. Regional Studies, 51:1, 46-57.

Radosevic, S. and Stancova, K. C., 2018. Internationalising smart specialisation: Assessment and issues in the case of EU new member states. Journal of the Knowledge Economy, 9(1), 263-293.

Rodríguez-Pose, A., 2018. The revenge of the places that don’t matter (and what to do about it). Cambridge Journal of Regions, Economy and Society, 11:1, 189–209.

Storper, M., 2018. Separate Worlds? Regional economic divergence and its populist offshoots, Journal of Economic Geography, Impulses Section, forthcoming.

UNCTAD, 2017. World Investment Report, United Nations: New York and Geneva.

Uyarra, E., Sörvik, J. and Midtkandal, I., 2014. Inter-regional collaboration in research and innovation strategies for smart specialisation (RIS3), JRC Technical Reports, S3 Working Paper Series, No. 06.

Yeung, H.W.C., 2016. Strategic Coupling: East Asian Industrial Transformation in the New Global Economy, Cornell University Press.

[1] https://ec.europa.eu/eurostat/statistics-explained/index.php/World_direct_investment_patterns

[2] https://www.equatex.com/en/article/who-runs-the-world/

[3]https://europa.eu/rapid/press-release_IP-18-4228_en.htm

[4]https://www.economist.com/briefing/2017/01/28/the-retreat-of-the-global-company (last accessed on 21/08/2018).