Why do some firms weather crises while others disappear? And what role do productivity and geography play in determining who survives? These questions are at the heart of understanding how economies recover from downturns.

Productivity is one of the main engines of long-term growth and competitiveness. A central lesson from economic research is that competition drives productivity: in dynamic markets, new firms enter while the least productive ones exit, freeing up resources to allocate to more efficient uses. Ideally, this process improves overall performance. But when resources such as labor and capital are not directed toward the most productive firms, misallocation occurs, lowering the economy’s efficiency.

In “normal times,” larger and more integrated markets encourage faster reallocation, as competition pushes firms to adapt or exit. Yet recessions may disrupt these dynamics. Past crises suggest that urban areas tend to bounce back faster, while rural areas struggle for longer. The COVID-19 pandemic—with its severe shock and extraordinary policy responses—raises a pressing question: did misallocation worsen, and did policies designed to save jobs alter the usual patterns of firm exit and survival?

The Case of Spain

Spain offers a particularly relevant case. First, the country has long struggled with a weak productivity performance, which researchers have linked to problems of misallocation. Second, during the COVID-19 crisis, Spain introduced an ambitious job retention program—the Temporary Workforce Reduction Schemes (ERTEs)—to protect employment. Launched in March 2020 and extended until March 2022, ERTEs were unprecedented in scale, with around 4.4 million workers benefiting, at a cost of roughly € 20 billion.

The empirical evidence on ERTEs points to mixed outcomes. While the program saved many jobs, it also delayed the movement of workers from less productive to more productive firms (Díaz et al., 2025). In other words, ERTEs bought time but may also have prolonged inefficiencies.

Our Research

In our new research funded by the British Academy and Leverhulme Trust, we examined how the relationship between productivity and firm exit depends on location and varies during crisis times such as the COVID-19 pandemic. We place a particular focus on the role of market potential in shaping firm survival. We used geo-localised data from the SABI database (Sistema de Análisis de Balances Ibéricos), which provides detailed balance sheet information on Spanish manufacturing and services firms.

The data reveal striking spatial disparities. Figure 1 illustrates the Distance to the Productivity Frontier—the gap between a firm’s productivity and that of the most efficient firms in its industry and year—across Spain in 2022. Firms closer to the frontier (shown in red and orange) are concentrated in major urban and industrial regions such as the Basque Country, Navarra, Catalonia, the Valencian Community, and Madrid. Meanwhile, firms further from the frontier (dark green) tend to be concentrated in rural and inland areas.

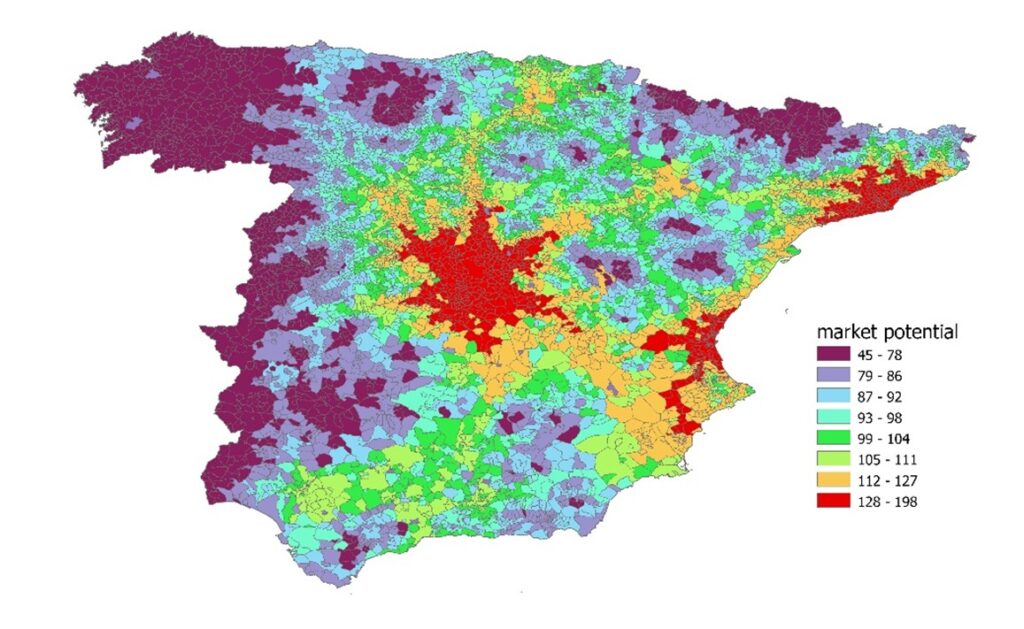

We also mapped (Figure 2) domestic market potential at the municipal level, which captures firms’ access to markets of different sizes along the road transportation network in Spain. Here too, disparities are evident: the highest domestic market access is found in the Madrid area, Catalonia, and the Valencian Community.

What We Found

Our analysis confirms a central idea: more productive firms are more likely to survive. Yet the relationship is location-dependent. Firms in high-market-potential areas—those with greater access to customers— even if relatively productive, face higher probabilities of exit, most likely due to stronger competition in those markets.

However, this effect weakened during the COVID-19 crisis. The spatially blind nature of government support measures, combined with reduced economic interaction during lockdowns, appears to have dampened the influence of market potential on the “cleansing” role of firm exit. Sectoral differences also matter: in services, location strongly shaped survival outcomes. In contrast, in manufacturing, the relationship between productivity and survival did not significantly differ across areas with different market potential, even before 2020.

Key Takeaways

What can policymakers and businesses learn from Spain’s experience? Three lessons stand out:

- Job retention schemes like ERTEs protected millions of workers at the height of the pandemic. But by slowing the reallocation of labor toward more productive firms, they also risked holding back long-term competitiveness. The challenge for policymakers is clear: how do you protect employment in the short run without undermining growth in the long run?

- Location still matters: Urban and industrial core regions host firms closer to the productivity frontier, while rural and lagging areas remain at a disadvantage. Any strategy to boost competitiveness must therefore take these persistent regional divides into account.

- Crises change the rules—temporarily: The COVID-19 shock weakened the link between market potential and the firm’s productivity-survival relation. Spatially blind government support and reduced economic interaction muted the “cleansing effect” of competition.

Read more about this research: D’Costa, S., & Holl, A. (2025). Firm productivity and exit during economic crisis: does market potential foster resilience? (Westminster Business School Working Paper Series), University of Westminster.

Connect with the Authors

Sabine D’Costa is a Senior Lecturer in Economics at the University of Westminster. She is also an external member of the Centre for Globalisation Research at Queen Mary University of London. She is currently an Associate Editor of Regional Studies, Regional Science. Her research has focused on agglomeration economies, the urban wage premium, regional disparities in firm productivity and survival, regional growth and the labour market impacts of transport investments. She has previously worked at the London School of Economics and Queen Mary University of London and has consulted for the NGO and public sector.

![]() : Sabine D’Costa

: Sabine D’Costa ![]() :0000-0002-7143-993X

:0000-0002-7143-993X

Adelheid Holl is a tenured researcher at the Institute of Public Goods and Policies of the Spanish National Research Council (CSIC). She is Editor of Regional Studies, Regional Science. Her research is primarily at the intersection of applied micro-economic analysis and economic geography and concentrates on the performance, location and organisation of firms. She has previously worked at FEDEA (Fundación de Estudios de Economía Aplicada – Madrid) and the University of Sheffield.