Bruno D. Castanheira works with the European Commission in securing the Union’s financial interests, having previously worked to improve implementation of Regional Policy. His research to stabilise European Economic Integration explored new approaches to Regional Policy and the role of financial instruments in Cohesion founded on behaviourist, industrial and financial economics. You can find him on twitter at @BrunoDuarte_, or connect with him on LinkedIn or his own blog.

A Eurozone Budget: Institutional Context

A Eurozone convergence and competitiveness budget should focus on narrowing the dispersion (or standard deviation) of inputs, outputs and income. There are two known proposals to achieve this objective: the Commission proposes a counter-cyclical debt instrument tackling transitory shocks by stimulating aggregate demand through public spending. Council’s proposal focuses instead on a precautionary role that delivers structural change by narrowing the standard deviation in inputs, outputs and income amongst Member-States.

The Commission’s proposal improves on that advanced by Paul de Grauwe (pp. 137-150) in 2016 who argued for a counter-cyclical budget that redistributes fiscal revenues to ease the pressure on government funding during shocks. As it stood, Mr. De Grauwe’s proposal would require an upheaval of the Union’s institutional framework and a renegotiation of the ToFEU’s Article 123 that explicitly forbids such transfers.

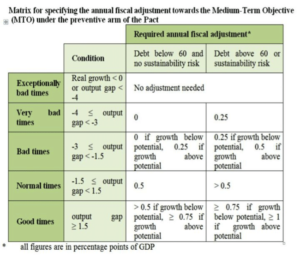

To promote effective convergence, Member-States agreed on a mechanism that coordinates supply and demand-side economics to deliver structural and economic (output gap) convergence in a single framework instead of compensating for transitory asymmetries – Theo Waigel’s SGP matrix.

Figure 1. Medium Term Objective Matrix

The matrix rejects an expansionary role for governments, while upholding certain social market economy principles: private enterprise, social protection and regulation to improve living conditions (Article 151 ToFEU).

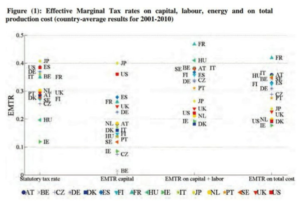

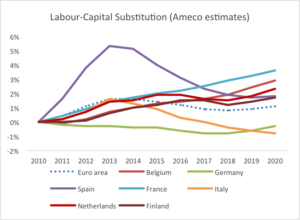

Because the legal basis also accounts for the diversity of contractual relations, policy makers seek the harmonisation of living conditions across the Union through the relative convergence of firm competitiveness while maintaining price stability (Article 119 ToFEU). You would expect European markets clear within a narrow price band (for Member-States still in Accession, Article 140 and Protocol 13 ToFEU) whilst in fact price dispersion is large across the Union. This translates to different levels of input factor cost and implies different capital-labour elasticities of substitution in firms across the Union.

In what concerns firm competitiveness, Member-States consider whether input factors are substitutable or complementary. If factors are substitutable, policy makers presumably increase labour protection and fund social spending through taxes on personal income/consumption as substitutability is higher/lower. In such labour intensive economies, wages adjust less frequently and demand is more sensitive to prices.

Figure 2. Effective Marginal Tax

Conversely, salaries adjust more frequently in Member-States economies where capital and labour are complementary as labour protection is less stringent. In these economies, social spending is optimally financed through taxes on capital/consumption as complementarity is higher/lower. As capital intensity anchors firm pricing strategies, markets clear with higher capital investment turnover thus demand is less sensitive to prices.

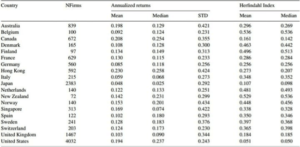

In turn, product market competition (measured below by computations of the Herfindahl Index, where a low value implies more intense competition) influences price stability across the Union and steers Member-States in drafting convergence policies.

Figure 3. Herfindahl Index

Competition and stabilisation: different intensities, different stimuli

When seeking firm competitiveness while guaranteeing price stability, Member-States must foresee how product market competition (on the demand side) interacts with input factors (on the supply side) to deliver convergence, stabilisation and competitiveness. For instance, when capital and labour complement each other, an increase in aggregate demand in less competitive product markets would imply higher unemployment and higher real interest rates.

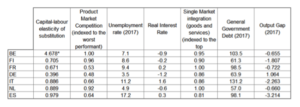

Figure 4. Jurisdictional data on product market competition.

Conversely, in competitive product markets such as France and Germany, capital-labour complementarity implies an inflationary stimulus to aggregate demand could transitorily narrow the output gap assuming labour markets are deep enough to accommodate inflationary pressures caused by increasing real wages.

The governments of Belgium, the Netherlands or Finland would not plan a similar stimulus package though. In these Member-States, where capital and labour are likely substitutes, less intense product market competition (p.14) would drive an increase in the long-term unemployment rate if governments were to enact an inflationary demand stimulus, broadening the output gap. Such stimulus would put upward pressure on wages and on the long-run equilibrium unemployment, thus depressing real wages. In these Member-States, the most effective stimulus would rather include competition-enhancing (p.1189) reforms.

Because input factors are (close to) substitutes in most Member-States, the SGP adequately constrains fiscal spending (thus upholding higher real interest rates) when the output gap is negative, instead stimulating factor employment (labour).

Different capital-labour elasticities of substitution suggest the private sector absorbs inflationary demand stimuli at different paces. Higher mark-ups in less competitive product markets (Netherlands, Belgium, Finland) imply a slower uptake of private (capital) investment (as firms compute lower net present values as a result of lower real interest rates), whereas in more competitive product markets (France, Germany) higher mark-ups imply a quicker reaction by firms. Finally, Member-States must consider how a stimulus to aggregate demand affects social protection: it would likely increase unemployment in economies where capital-labour are substitutes while subsiding it in economies where capital and labour are complements.

Figure 5. Labour Capital Substitution.

This complex panorama of interest rates, positive and negative output gaps and thus different investment absorption rates poses a challenge to European policy makers setting the policy interest rate or crafting a convergence and competitiveness budget.

Both institutional framework and idiosyncratic economic structure shape how policy makers devise measures to stimulate convergence and competitiveness. The following and final post of this series offers an economic framework for the Eurozone Budget.

Are you currently involved with regional research, policy, and development, and want to elaborate your ideas in a different medium? The Regional Studies Association is now accepting articles for their online blog. For more information, contact the Blog Editor at RSABlog@regionalstudies.org.